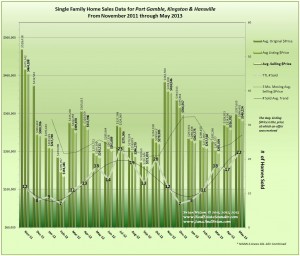

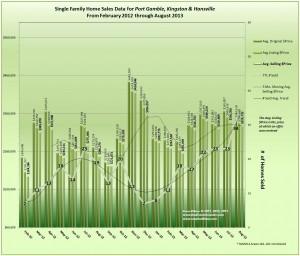

Home Sales & Prices in Kingston, Port Gamble, & Hansville August 2013 including 18 months prior data

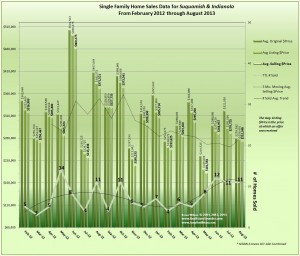

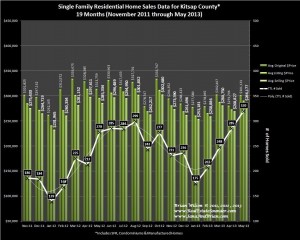

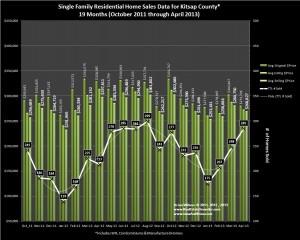

Wow! Someone must have given away the secret about this area, and as we predicted in our June Report, home sales and prices have been on fire in this combined market area of Hansville, Kingston and Port Gamble. Average and median selling prices were significantly above the levels for the same period one year ago and while the number of homes sold in July of 2013 were identical to the number sold in July of 2012, June and August numbers far exceeded the levels for the same months one year ago.

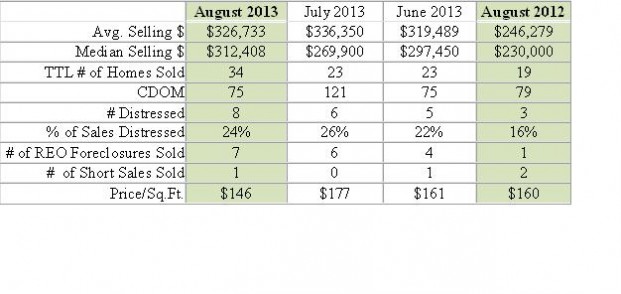

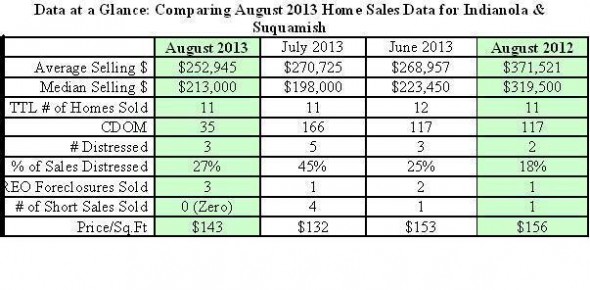

Here’s the monthly data at a glance for the last 3 months and we’ve included the data for August 2012 to help you easily compare the current August 2013 data with the same period one year ago:

The Average Sold home price was up almost 33% from the same period one year ago and the Median home sales price was up almost 36%! Impressive, but so is the number of homes sold in August 2013 compared with the same period one year ago: up almost 79!

Here’s a look at the current inventory of Active listings and Pending sales:

There are currently (as of 9/10/13), 104 Active listings which represents only about a 3 month supply (we apologize for an error when we first published this yesterday on 9/10. We reported this to be a 1.4 month supply of homes, but we slipped a column in our data. We’ve since verified all of the other data).

This relatively low level of inventory is typically associated with a Seller biased market and is an environment where it would be common to have multiple offers and back up offers for many properties, and it recently happened to one of my clients when their dream home went Sale Pending in only one (1) day and there were two (2) Backup offers. To be the successful buyer in this kind of market, you just have to be ready to act quickly as soon as the right home comes on the market and you need to be prepared to make your first offer your best offer.

These Active listings have an average asking price of $435,207 and a Median asking price of $320,450. The high average price and the large gap between the average and median values is due to a large number of high price properties that are on the market. Currently there are 9 properties in this area that are near or over a $1 Million asking price with one at $2.5 Million.

As for Pending Sales, there are currently 48 homes in some Pending Sale status in this combined area.

Current Trends: For the currently Pending Sales, the Average asking price is $308,655 and the Median price is $265,831, but keep in mind that actual Average Selling prices have tended to be about 2.2% below the Sale Pending Price.

With only 2 recorded sales month to date, it appears the number of homes that will be recorded sales for September will almost certainly be less than the extraordinary high number of homes Sold in August and it also appears that the Average and Median selling prices will slightly decline for September.

Thank You for visiting our blog. We hope you will bookmark it in your browser and come back often, or we invite you to ![]() Get the RSS feed

Get the RSS feed

Brian Wilson, Broker; mobile: 360-689-2466

-and-

Jana Salmans, Managing Broker; mobile: 360-509-9684

John L. Scott Real Estate

19723 10th Ave NE; Suite 200

Poulsbo, WA 98370

Data Source: Northwest MLS (NWMLS)

The NWMLS, Brian Wilson or Jana Salmans do not guarantee the accuracy of this data and are not responsible for it’s accuracy. Data from the NWMLS may not reflect all real estate activities in the market. Information deemed reliable but not guaranteed.